Uk Gambling Tax Free

- Gambling Industry in the UK with the Explanation of the Tax to Government Online gambling industry is one of the fast-rising sectors in the world with regular progress and new innovations. Even, the technology has developed the industry in an amazing way that helps the developers to develop creative gaming enthusiasts.

- In the UK any and all winnings from gambling – either online or at betting shops – are entirely tax free and do not need to be declared as part of any tax return. This has been the case since the then Chancellor of the Exchequer Gordon Brown’s budget of 2001, when he abolished Betting Duty which had stood at 6.75%.

Gambling Industry in the UK with the Explanation of the Tax to Government

Gambling Tax Free Uk

Online gambling industry is one of the fast-rising sectors in the world with regular progress and new innovations. Even, the technology has developed the industry in an amazing way that helps the developers to develop creative gaming enthusiasts.

But whatever game you want to play, it is difficult to do anything in your life without paying to the government in the form of tax. The gambling industry is also not exceptional in such a case. If you win in any casino gambling game, you have to provide information about your gambling winnings to the government first. But here are some tax explanations of the Gambling industry in the UK that would definitely make you surprised.

Gambling is not only 100% legal in the UK, while players are also in a position to take home everything in which they win. Laws and legislation means that those in Scotland, Wales, Northern Ireland and England are able to take advantage of tax free winnings, something which is not the case in other locations across the globe. In general, no UK gamblers/traders will pay tax on their winnings. They are Tax Free. The Inland Revenue has now shifted to onus of any tax liable, to be paid by the companies, bookmakers, and trading outlets – such as Betfair, and this takes a whole heap of pressure of the punters/gamblers. HM Revenue & Customs doesn't regard lottery winnings as income, so all prizes are tax-free – hurray! However, there could be tax implications once you've banked your winnings.

UK Gambling Tax System:

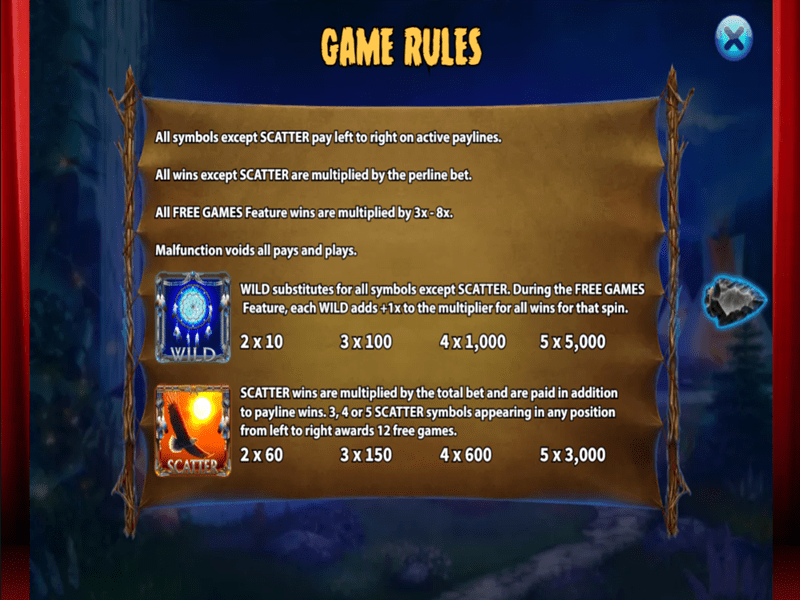

The tax system for UK gambling is very advantageous for the players. Not only does it would work in your favour but it is also very easy to understand and follow their rules and regulations.

Whenever you play casino games in the UK, you don’t need to pay any tax to the government, whatever it is. You don’t have to pay tax on your winning money and not even you have to pay tax on your initial stake. So, it simply means that you don’t have to inform your winnings to the taxman. So, for example, if you win Euro 4000 at an online casino, you can keep the entire amount with you. This is great differences in the policies of gambling winnings with other countries where you are not able to keep the whole amount of your winnings with you.

Who then Get Taxed in the UK for Gambling?

The gambling industry is worth a lot of money, thus, the UK government taxes the operators instead of the players. However, this was not happened in past. Previously, the player also used to pay tax to the government either in the form of tax on your stake or as a tax on your winnings.

In the year 2002, the UK government realized that the gambling industry of the UK would not be able to compete with the online gambling industry of the UK and other parts of the world. The government then decided to eliminate the tax from the players and keep the tax of the operator and we can see today that the decision was successful.

Gambling as a Profession in the UK:

So, becoming a gambling professional might be the only professions that is not actually taxed in the UK. If you are already gambling for a living or planning to take the gambling industry as your profession, then you are the lucky one as you don’t need to pay a single penny to the taxman on your gambling winnings. The reason for taking such decision by the government is very simple. According to the current tax system in the UK, if the government was allowed to tax you for doing any activity like gambling, then you would have the ability to claim your money back from the government for any losses.

My understanding that is UK trading is free of tax for all, however, if this was your full time job surely Mr Taxman would like to take some money from you somehow?

Uk Gambling Winnings Tax Free

Unfortunately you are incorrect with regard to the tax situation in Britain. Trading is not tax free in the United Kingdom. However there is a loophole within the betting and gaming industry that profits from gambling are free of tax to the gambler and some consider financial spread betting as a shelter in which you can stick speculative investments to avoid Capital Gains Tax. So if you bet on forex (trade) via a spread bet company with your own money and on your own behalf with no financial interest from any other party, then currently you will not be liable to tax on your gains.

Just to add if you are trading rather then spread betting, there is a capital gains allowance of around 10k per year which you should put to good use, assuming you’ve not sold a second property or stocks or anything else which is also taxable.

Also, importantly spread betting trades are free from stamp duty which makes spread trading especially attractive for short-term traders; especially speculators that open and close trades within one day. The reason that stamp duty is non-levied is because with spreadbets you are buying a derivative of the stock, so you don’t actually own the underlying stock. Of course, this also means that if you buy LLoyds TSB’s shares in a spread bet you won’t be able to turn up at the annual meeting.

As IG Index puts it ‘financial spread bets as far as a client is concerned are treated the same way as a horse racing flutter, and as such you do not pay tax on your winnings. Consequently, you cannot offset your losses against tax. Clients are not liable for stamp duty as we as a spread betting provider pay duty direct to HMRC.’

A spokesman of Capital Spreads had this to say:

‘As yet the industry has yet to find a single reported instance of HMRC succesfully claiming tax against a winning spread betting client (but I believe they have tried a couple of times). Ringing up any government organisation and asking for an authorised statement is worthless as they are specifically told not to respond to queries such as these (as the conversation may be recorded and used in defence!). The fact is that tax on capital gains is still the same today as it was back in the 1970’s. It is all very well having capital gains tax but it is another matter trying to identify it and actually getting profitable traders to report their liabilities.’

‘With spread betting and CFD companies the trades are all within one unit (i.e. you cannot settle a spread bet trade taken with one provider by closing out with another, different, company). So it is much easier to just tax the spread betting company (both corporation tax and gaming duty). The revenue earns far more through this route than it ever will by attempting to tax individual client profits.’

Note: Tax laws can of course change but historically and at the present time, investors using this form of trading are not liable for capital gains tax (CGT) on any gains, a useful property compared to traditional share trading. Note also that CGT in any case only becomes payable if your total combined gains from all sources exceed £10,600 during tax year 2012-2013

“There is the tax position to consider with spread betting. Even if holding for the long term there is No CGT on your stock holding (if held through a spreadbet) and no income tax on your dividend stream. And no need to keep records for HMRC”